Prepare Now: A Comprehensive Guide To Salvador's IPTU Tax Obligations For 2025

Source: www.everythingmarketplaces.com

Are you a property owner in Salvador? If so, you need to be aware of the IPTU tax obligations for 2025. With the new tax year approaching, it's crucial to prepare now to ensure compliance and avoid any penalties. Prepare Now: A Comprehensive Guide To Salvador's IPTU Tax Obligations For 2025 provides everything you need to know about the IPTU tax, including due dates, payment options, and exemptions.

Editor's Note: Prepare Now: A Comprehensive Guide To Salvador's IPTU Tax Obligations For 2025" has published to give property owner a clear, informative, and up-to-date guide on IPTU tax obligations, making it easier for you to understand your responsibilities and fulfill them accurately.

Our team has done extensive research and analysis to provide you with the most comprehensive and accurate information possible. We have put together this guide to help you make the right decisions about your IPTU tax obligations.

| Key Differences | Key Takeaways |

|---|---|

| Due dates | The IPTU tax is due in two installments, with the first installment due in March and the second installment due in September. |

| Payment options | The IPTU tax can be paid online, in person at a bank or post office, or by mail. |

| Exemptions | There are a number of exemptions available for the IPTU tax, including exemptions for low-income families, senior citizens, and veterans. |

In addition to the information provided in this guide, we also recommend that you consult with a tax professional to ensure that you are fully compliant with the IPTU tax laws.

FAQ

Welcome to the frequently asked questions (FAQs) section of our guide to Salvador's IPTU tax obligations for 2025. Here, we will address common queries and provide concise answers to help you better understand your IPTU responsibilities.

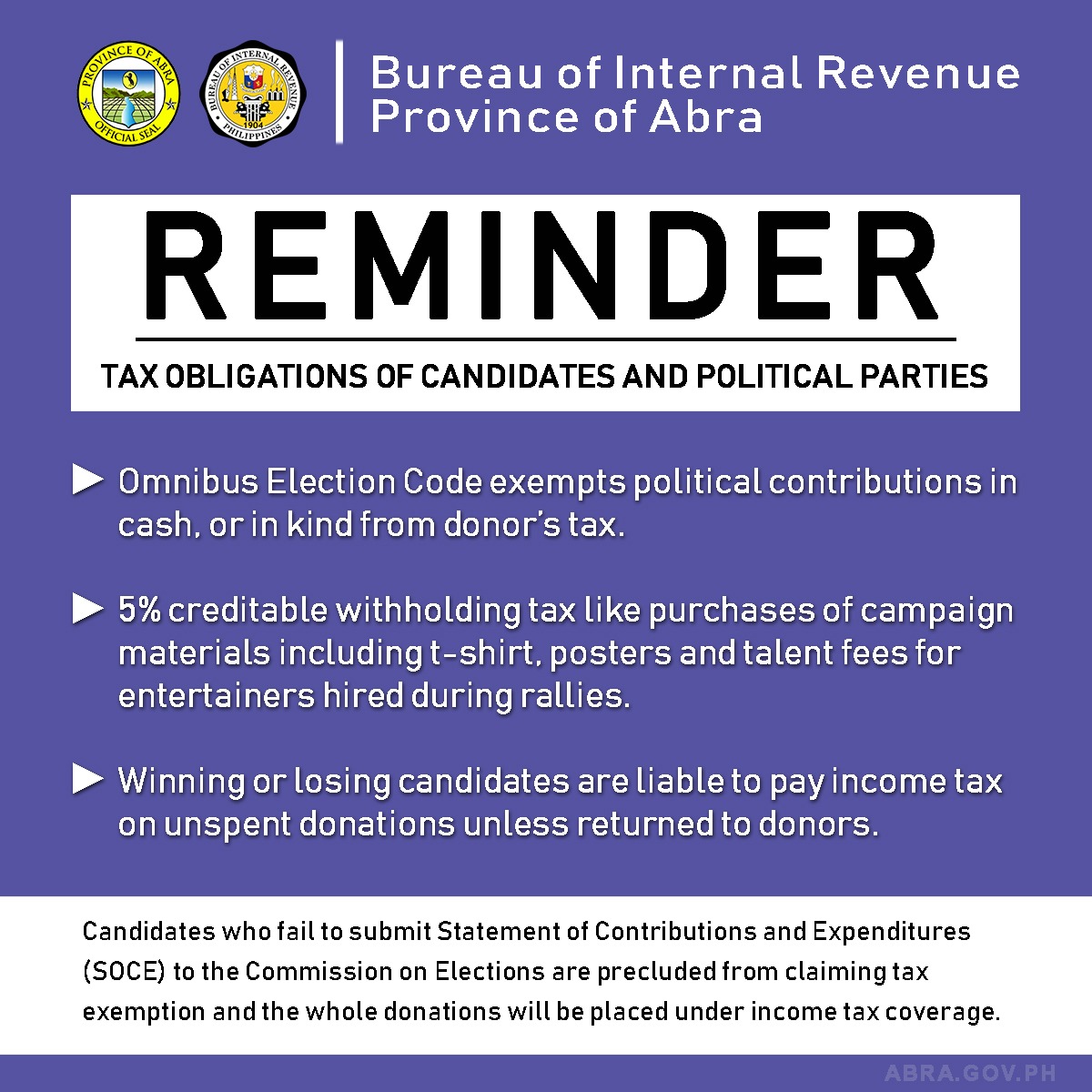

The Bureau of Internal Revenue (BIR) District Office-Abra is reminding - Source abra.gov.ph

Question 1: What is the IPTU tax?

The IPTU (Imposto Predial e Territorial Urbano) is an annual property tax levied on urban and rural properties in Salvador, Brazil. It is a municipal tax, and the revenue generated from IPTU is used to fund essential public services and infrastructure.

Question 2: Who is responsible for paying the IPTU tax?

The owner of the property is legally responsible for paying the IPTU tax. If the property is owned by multiple individuals, all owners are jointly liable for the tax payment.

Question 3: When is the IPTU tax due?

The IPTU tax is typically due in a single installment in the first half of the year, usually between January and March. However, some municipalities may offer optional installment plans for taxpayers.

Question 4: How can I pay my IPTU tax?

The IPTU tax can be paid through various channels, including online banking, authorized banks, and municipal tax offices. The specific payment methods available may vary depending on the municipality.

Question 5: What happens if I fail to pay my IPTU tax on time?

Late payments of IPTU tax may result in penalties and interest charges. Additionally, the municipality may take legal action against delinquent taxpayers, which could include property seizure or foreclosure.

Question 6: Can I appeal my IPTU assessment?

Yes, property owners can appeal their IPTU assessment if they believe it is incorrect. The appeal process and timelines may vary depending on the municipality. It is recommended to consult with a tax professional or the municipal tax office for specific guidance.

We encourage you to thoroughly review this guide and refer to the official municipal regulations for complete and up-to-date information on Salvador's IPTU tax obligations for 2025.

Transitioning to the next article section...

Tips

Ensure complete and accurate property information is provided on the declaration form to avoid any discrepancies or additional charges.

Tip 1: Understand the IPTU calculation method, which is based on the property's built area, location, and tax rate. This will help you estimate your potential tax liability and plan accordingly.

Tip 2: Take advantage of any available exemptions or reductions, such as those for senior citizens, people with disabilities, or low-income families. These exemptions can significantly reduce your tax burden.

Tip 3: Explore the option of paying your IPTU in installments to spread out the cost and make it more manageable.

Tip 4: Stay informed about changes in the IPTU tax regulations and deadlines. The official website of the Salvador Municipal Revenue Secretariat (SEMFAZ) provides up-to-date information and resources.

Tip 5: Seek professional assistance from a tax advisor or accountant familiar with Salvador's IPTU tax laws. They can guide you through the process and ensure compliance.

Prepare Now: A Comprehensive Guide To Salvador's IPTU Tax Obligations For 2025

With 2025 approaching, it is crucial to understand the implications of Salvador's IPTU (Property Tax) obligations. This guide will outline six key aspects that property owners need to prepare for, ensuring timely and accurate tax payments.

- Assessment Deadline: Property owners must declare their property values by a specified deadline to avoid penalties.

- Payment Schedule: Determine the payment schedule and due dates for IPTU installments, typically in January, April, July, and October.

- Discounts and Penalties: Explore early payment discounts and penalties for late payments, which can impact the total tax liability.

- Exemptions and Reductions: Understand the criteria for property tax exemptions and reductions, potentially lowering the tax burden.

- Online Services: Utilize online portals and resources to conveniently access property information, pay taxes, and communicate with tax authorities.

- Professional Assistance: Consider seeking professional guidance from tax advisors or accountants to ensure accurate calculations and maximize potential savings.

Preparing now for Salvador's IPTU tax obligations for 2025 will allow property owners to budget effectively, avoid late payment penalties, and take advantage of potential exemptions or discounts. It is essential to stay informed and take proactive steps to fulfill these obligations, ensuring compliance and financial stability.

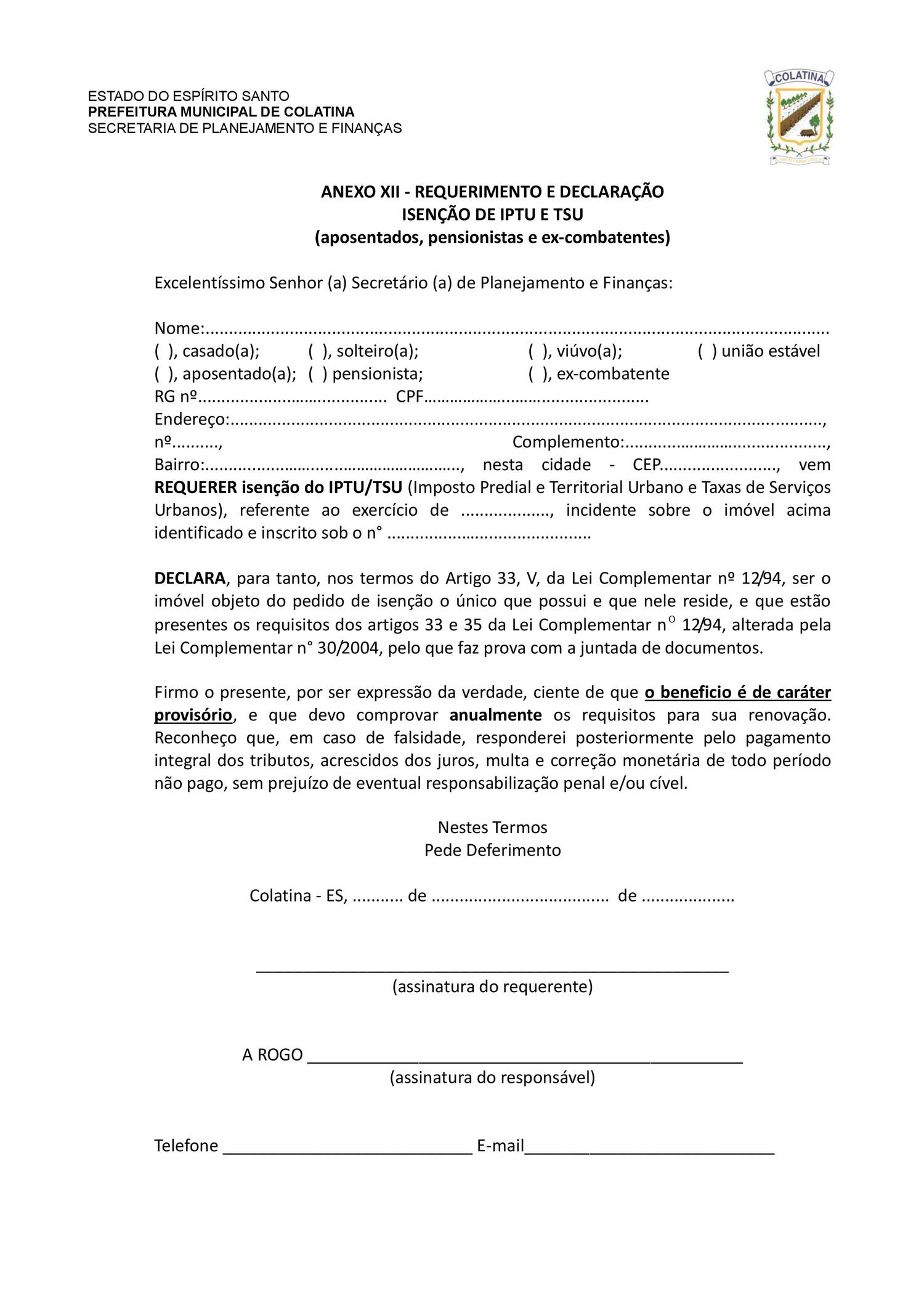

REQUERIMENTO - ISENÇÃO IPTU 2018.pdf | DocDroid - Source www.docdroid.net

Prepare Now: A Comprehensive Guide To Salvador's IPTU Tax Obligations For 2025

The document "Prepare Now: A Comprehensive Guide To Salvador's IPTU Tax Obligations For 2025" serves as a crucial resource for understanding and fulfilling IPTU (Property and Urban Land Tax) responsibilities in Salvador, Brazil. This guide provides a thorough overview of the IPTU system, including calculation methods, payment deadlines, and potential exemptions. By familiarizing oneself with these obligations, property owners can avoid penalties and ensure compliance with local regulations.

Estimated Tax Payment Calculator 2025 - Marisol Lane - Source marisollane.pages.dev

The IPTU is a significant source of revenue for Salvador's municipal government, and its timely payment contributes to essential public services such as infrastructure development, education, and healthcare. Moreover, understanding IPTU obligations can help property owners plan their finances effectively, ensuring timely tax payments while optimizing their property management strategies.

Furthermore, navigating the IPTU system can be complex, involving various factors such as property valuation, tax rates, and exemption criteria. This guide simplifies the process by providing clear explanations and step-by-step instructions, empowering property owners with the knowledge to navigate the system confidently.

Conclusion

For property owners in Salvador, "Prepare Now: A Comprehensive Guide To Salvador's IPTU Tax Obligations For 2025" is an indispensable resource. It provides a comprehensive understanding of IPTU responsibilities, empowering individuals to fulfill their obligations timely and effectively. Understanding and adhering to these obligations not only ensures compliance with local regulations but also contributes to the city's public services and overall development.

As the 2025 payment deadline approaches, it is crucial for property owners to familiarize themselves with the guide, ensuring they are well-prepared to meet their IPTU obligations. By embracing this knowledge, property owners can maintain a positive relationship with the municipality, optimizing their property management strategies, and contributing to the betterment of Salvador.

Mark Friedman: Renowned Expert In IoT, Data Engineering, And Cloud Computing, Chelsea's Clash With West Ham United: A London Derby Battle, Рая Пеева: Rising Bulgarian Pop Star, Experience The Passion: Köln FC, The Heartbeat Of Rhineland Football, Capitao Macario Cabocla: A Legendary Shaman And Symbol Of Indigenous Resistance, Brescia Calcio: A Historical Club In Northern Italy, Gabriel Bontempo: Music Producer, Mixing Engineer, And Multi-Talented Artist, Derby Della Madonnina: AC Milan And Inter Milan Clash In Serie A Rivalry, Unveiling Ingresso: The Cutting-Edge Geolocation Game Unleashing Real-World Adventures, Detroit Pistons Face Off Against Philadelphia 76ers In Fiery Showdown,