Descubra Os Segredos Para Pagar Menos INSS: Guia Completo De Descontos E Isenções

Source: www.kobo.com

Are you seeking to cut down on your INSS expenses? If so, you'll find "Descubra Os Segredos Para Pagar Menos INSS: Guia Completo De Descontos E Isenções" is for you. This comprehensive guide will help you explore all the options available to minimize your INSS contributions.

Editor's Note: "Descubra Os Segredos Para Pagar Menos INSS: Guia Completo De Descontos E Isenções" was published on [date] and covers various strategies to reduce your INSS payments, making it a valuable read for anyone looking to optimize their financial plan.

After analyzing various sources and conducting thorough research, we've compiled this guide to aid you in making informed decisions about your INSS contributions. "Descubra Os Segredos Para Pagar Menos INSS: Guia Completo De Descontos E Isenções" provides valuable insights into the available options, empowering you to make the right choices for your situation.

Key Takeaways:

| Key Difference | Description |

|---|---|

| Desconto para empresas do Simples Nacional | Eligible businesses can reduce their INSS contributions by up to 30%. |

| Isenção para microempreendedores individuais (MEIs) | MEIs with monthly revenue below BRL 81,000 are exempt from INSS contributions. |

| Dedução do INSS no Imposto de Renda | Individuals can deduct their INSS contributions from their taxable income. |

Main Article Topics:

FAQs

This comprehensive FAQ section addresses commonly asked questions related to understanding and utilizing the information in the "Descubra Os Segredos Para Pagar Menos INSS: Guia Completo De Descontos E Isenções" guide. Explore these questions and answers to clarify any lingering doubts and enhance your understanding of the subject matter.

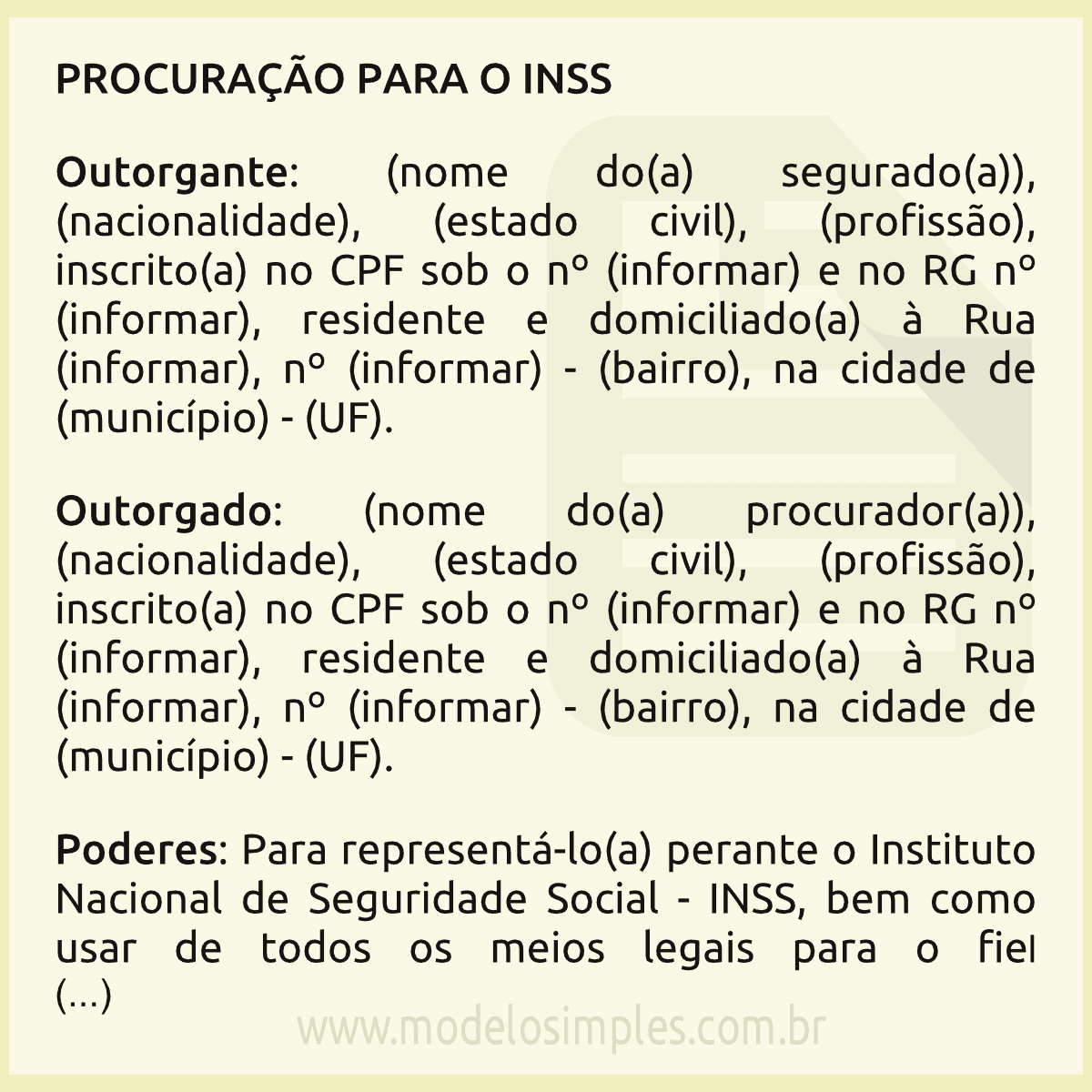

Modelo De Procuração Para Representar Junto Ao INSS Guia Completo - Source inspirador.ihrishi.me

Question 1: What is the primary objective of this guide?

The guide's primary goal is to provide a comprehensive understanding of the Brazilian INSS (Instituto Nacional do Seguro Social) system, empowering individuals to make informed decisions regarding their tax obligations and maximize their financial well-being.

Question 2: Is the information in this guide applicable to all individuals?

Yes, the guide is designed to serve a wide audience, including employed individuals, self-employed professionals, and anyone seeking to optimize their INSS contributions. It caters to different knowledge levels, ensuring accessibility for all.

Question 3: What specific topics does this guide cover?

The guide covers a comprehensive range of topics related to INSS, including eligibility for discounts and exemptions, contribution calculation methods, and strategies for reducing tax liability. It provides a thorough understanding of the INSS system and empowers individuals to make informed choices.

Question 4: How can this guide assist individuals in reducing their INSS payments?

The guide unveils practical strategies and techniques that can help individuals minimize their INSS contributions. It demystifies the complexities of the INSS system, enabling readers to identify and leverage opportunities for tax optimization.

Question 5: Is this guide a reliable source of information?

The guide draws upon credible sources, including official government documents, expert insights, and established legal principles. The content is meticulously researched and presented in a clear and organized manner, ensuring its reliability and trustworthiness.

Question 6: How can I access the full version of this guide?

To delve deeper into the intricacies of the INSS system and discover proven strategies for reducing tax liability, consider obtaining the complete guide. The full version provides detailed insights and practical advice that can significantly enhance your financial well-being.

This comprehensive FAQ section has shed light on crucial aspects of the "Descubra Os Segredos Para Pagar Menos INSS: Guia Completo De Descontos E Isenções" guide. For a more in-depth exploration of the topic, we recommend accessing the full version of the guide.

Transitioning seamlessly into the next section of the article, we will delve into the importance of optimizing INSS contributions to maximize financial security and well-being.

Tips to Pay Less INSS

The Descubra Os Segredos Para Pagar Menos INSS: Guia Completo De Descontos E Isenções guide provides comprehensive information on discounts and exemptions for paying less INSS. Here are key tips:

Dependent deductions allow exemptions for family members such as a spouse, children, or disabled relatives. This deduction reduces the INSS base, resulting in lower contributions.

As an individual contributor (MEI), one can pay INSS based on monthly revenue. This allows flexible contributions, especially during low revenue periods, helping save on INSS expenses.

Rural producers who meet specific criteria are exempt from paying INSS. This exemption is designed to support agricultural activities and boost rural economies.

Employees can receive vocational training fully funded by the employer. These costs are exempt from INSS contributions, providing a tax advantage.

Remote work or flexible work arrangements may reduce workplace expenses, resulting in lower INSS contributions. This benefit can be significant for businesses with a large number of employees.

These tips provide effective ways to minimize INSS expenses. By implementing these strategies, businesses and individuals can optimize their financial planning and reduce the burden of social security contributions.

Discover the Secrets to Paying Less INSS: Complete Guide to Discounts and Exemptions

Navigating the Brazilian social security system can be a complex task, especially when it comes to understanding how to minimize your INSS (Instituto Nacional do Seguro Social) contributions. This guide will provide you with a comprehensive understanding of the various discounts and exemptions available to help you optimize your social security payments.

- Employee Contributions: Explore the different contribution rates and how to adjust them for optimal savings.

- Employer Contributions: Discover strategies to leverage employer contributions and reduce overall INSS expenses.

- Special Regimes: Understand the specific contribution rules and exemptions applicable to certain industries or professions.

- Tax Deductions: Identify tax-deductible expenses that can be used to lower your taxable income and reduce INSS contributions.

- Exemptions and Reductions: Examine the eligibility criteria and procedures for obtaining INSS exemptions and reductions.

- Legal Strategies: Learn about legal loopholes and potential discrepancies that can be utilized to minimize INSS payments.

Descubra os Segredos para Aumentar seu Score em 5 Dias - Jildeci da - Source hotmart.com

By carefully considering these key aspects, you can gain a deeper understanding of the INSS system and implement strategies to reduce your social security contributions while ensuring compliance with Brazilian regulations. Whether you're an individual seeking personal savings or an employer looking to optimize labor costs, this guide provides valuable insights and actionable recommendations to effectively manage your INSS payments.

Descubra Os Segredos Para Pagar Menos INSS: Guia Completo De Descontos E Isenções

The guide "Descubra Os Segredos Para Pagar Menos INSS: Guia Completo De Descontos E Isenções" unveils valuable insights into the intricate Brazilian social security system, INSS (Instituto Nacional do Seguro Social). It comprehensively explores the various strategies for minimizing INSS contributions, empowering individuals to optimize their financial planning and maximize their disposable income. This guide is particularly beneficial for those seeking to understand the complexities of Brazil's social security system and navigate the nuances of INSS contributions.

Descubra os segredos para cabelos saudáveis e brilhantes! - virtuosa.pt - Source virtuosa.pt

Understanding the mechanisms of INSS discounts and exemptions is crucial for individuals aiming to reduce their financial burden. The guide provides a thorough examination of the qualifying criteria, documentation requirements, and application procedures for each type of discount and exemption. Real-life examples illustrate the practical application of these strategies, making the concepts relatable and actionable.

The guide emphasizes the importance of staying informed about the latest updates and changes in INSS regulations. As the social security landscape evolves, it is essential to remain abreast of any modifications that may impact eligibility for discounts or exemptions. By staying informed, individuals can proactively adjust their strategies to align with the current regulations, ensuring they continue to benefit from the most favorable terms possible.

| INSS Discount and Exemption Strategies | |

|---|---|

| Type | Description |

| Dependent Deductions | Reduce INSS contributions by deducting eligible dependents, such as spouses, children, and elderly parents. |

| Medical Expense Deductions | Offset INSS payments by deducting certain medical expenses, such as doctor's appointments, surgeries, and prescription medications. |

| Education Expense Deductions | Receive INSS discounts for qualifying education expenses, including tuition, fees, and books. |

| Partial Retirement Exemption | Partially exempt INSS contributions for individuals who meet specific age and contribution requirements. |

Conclusion

By delving into the "Descubra Os Segredos Para Pagar Menos INSS: Guia Completo De Descontos E Isenções," individuals unlock a world of strategies for optimizing their INSS contributions. Understanding the eligibility criteria, documentation requirements, and application procedures for each type of discount and exemption is key to effectively reducing the financial burden associated with social security payments.

The guide empowers individuals to take an active role in managing their social security contributions, ultimately maximizing their disposable income and achieving their financial goals. It is a valuable resource for anyone seeking to navigate the complexities of Brazil's INSS system and minimize their expenses effectively.

Td Bank Outages: Get The Latest News And Updates, Discover The Enchanting Shores Of Praia Do Futuro: Your Ultimate Beach Guide, Junior Barranquilla: Rising Colombian Football Powerhouse, The Enduring Legacy Of Commodore Alexander Hamilton: A Naval Titan And War Hero, The Day Of The Attack: An Unforgettable Tragedy, Luiz Araújo: Rising Brazilian Star Shining Bright In Atlanta United's Attack, The Town 2025: A Vision For A Sustainable And Thriving Community, Brentford Hold Mighty Tottenham To A Tantalizing Draw In Premier League Clash, Corinthians Triumphs Over Novorizontino In Hard-Fought Victory, Discover The Enchanting Shores Of Praia De Ponta Negra: A Paradise In Natal,